Secure Your Retirement With NPS

NPS stands for National Pension System, also referred to as National Pension Scheme. A pension is like a ‘salary’ that you continue to receive after you retire, even when you are not working. But to enjoy that, you need to build a corpus through regular deposits. That is why Floatr encourages you to invest in the NPS.

The National Pension System was initiated by the Government of India and is regulated by the Pension Fund Regulatory and Development Authority (PFRDA). So it is a very safe investment option in which anyone between ages 18 - 70 can participate. Here’s how it works:

You, as a subscriber, contribute regularly to your own, unique pension account. (Each subscriber is allowed only 1 NPS account).

You can choose which asset(s) you want to invest in NPS - equities, government bonds, corporate debt and alternate investment funds.

Upon retirement, you can withdraw a part of the total fund (up to 60%) as a lump sum and use the remaining amount to purchase an ‘annuity’, which provides a regular pension for life.

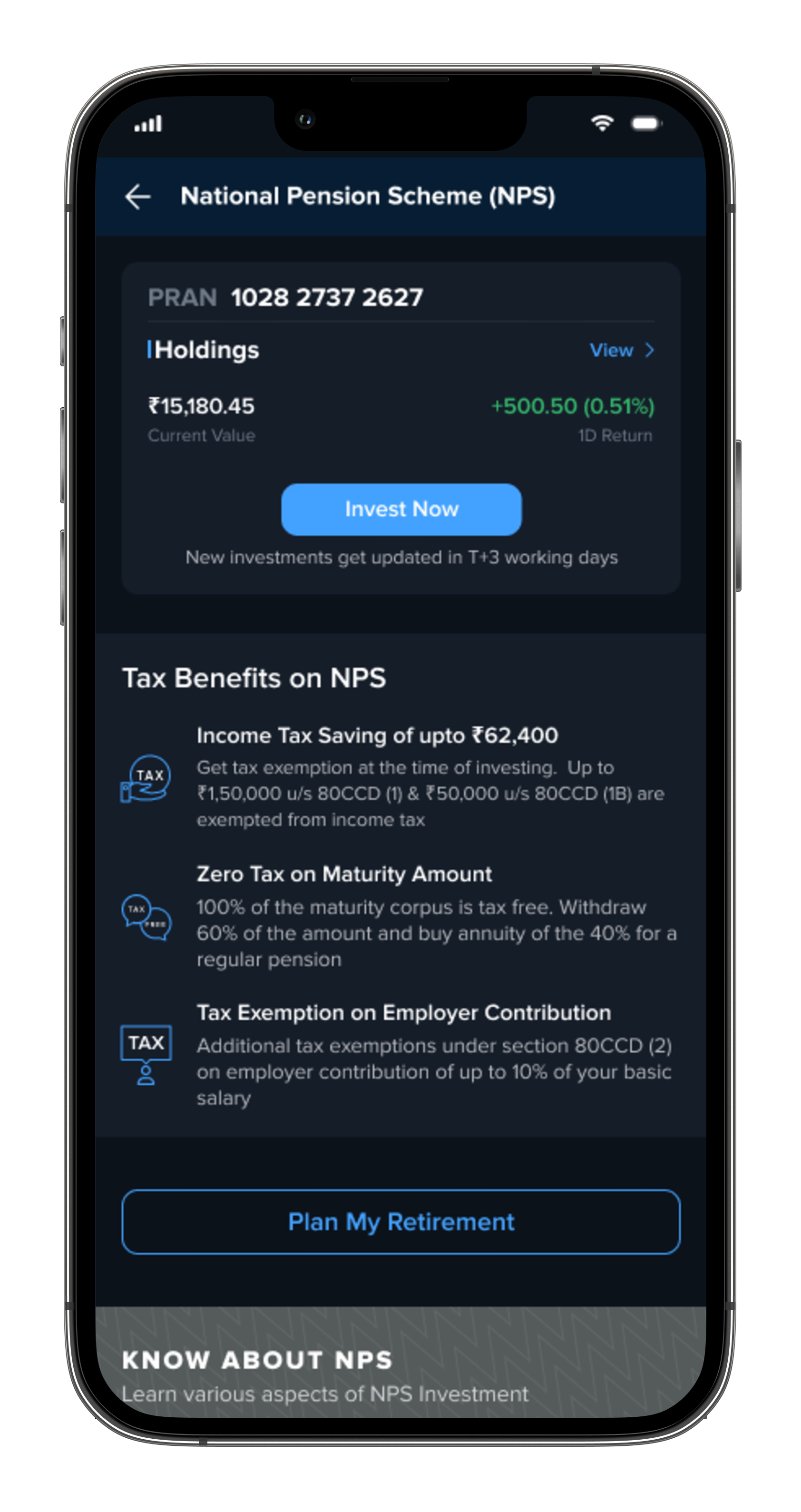

When you invest in NPS, you can ensure a stable income after retirement, enjoy tax benefits, and also gain flexibility and control over your retirement savings. With a NPS scheme online, you can

Build a corpus, ensuring financial security during your retirement years.

Choose your investment options based on your risk appetite.

Enjoy tax benefits under Section 80CCD(1), Section 80CCD(1B) and Section 80CCD(2) of the Income Tax Act, reducing your taxable income.

Benefit from the lowest fund management charges, maximising your returns.

Continue contributions even if you change jobs via your unique PRAN (Permanent Retirement Account Number).

Seize the Future with Floatr - NPS Made Simple

Floatr is With You Throughout Your NPS Journey

With Floatr's guidance, you can effortlessly navigate the NPS scheme online and make the most of your retirement savings. Say goodbye to complex procedures and hello to a smooth and straightforward journey with Floatr to invest in NPS!

At Floatr, we believe in forging meaningful partnerships built on trust and reliability. We are PFRDA registered

entity and service provider for NPS.

Simple & Hassle-free NPS Investment

Here's how simple and hassle-free an NPS investment is

Choose your Fund Manager

Floatr will help you select the Fund Manager who will manage your investments.

Pick Your Preferred Funds

There are 4 funds to choose from - Equities (E), Corporate Bonds (C), Government Securities (G), and Alternate Investment Funds (A).

Two Investment Approaches:

Active Choice

You can decide how to allocate your money across E, C, G, and A. The maximum exposure to E is limited to 75%, and A is capped at 5%.

Auto Choice

NPS offers three Life Cycle Funds - LC 75 (Aggressive), LC 50 (Moderate), and LC 25 (Conservative). Based on your age, Floatr will automatically invest your money in a predefined ratio across E, C, and G.

Auto Choice Adjustment

When you choose Auto Choice, Floatr will gradually reduce your equity exposure every year after the age of 35.

Subscribe to National Pension System (NPS) with Floatr

Investing in NPS Scheme Online with Floatr is Simple & Straightforward.

Get the Floatr app on your Android or iOS phone from the respective app store.

Upload two essential documents: Bank Cheque/Passbook/Bank Statement (to link your bank account for NPS contributions) and Photo of your signature (for authentication purposes).

Open the app and go to the NPS (National Pension System) page. Complete the registration process by providing the required details.

Make a minimum investment of ₹500 for a Tier 1 account. Additionally, you need to pay registration fees and POP (Point of Presence) charges, totaling ₹1,007.40.

Choose your preferred investment options from the available funds.

Review your investment details and confirm the subscription.

Receive your NPS account details, with the PRAN (Permanent Retirement Account Number) and your investment journey begins!

If you have any queries or need assistance, our experts are here to guide you throughout the process.

To SIP is the best ‘Tip’

Experience the convenience of modern technology merged with disciplined investing through Floatr's NPS SIP. SIP stands for Systematic Investment Plan. It is a method to invest in NPS where you regularly deposit a fixed amount in a NPS scheme online. Floatr offers you the opportunity to ‘SIP’ and grow your money steadily over time, contributing a fixed sum on a regular basis, enjoying multiple benefits.

Calculate Your Returns, Corpus and Monthly Pension in the NPS Calculator

Calculate how much to invest in NPS & maximise your returns from the NPS scheme online. Utilise the Digital NPS Calculator to accurately build your retirement corpus and make informed financial decisions.

Regular Deposits Into NPS Will Secure Your Financial Future. Start Investing Now

It’s time to start building the nest egg with a trusted and empathetic partner. Download the Floatr app now and secure your

financial freedom post-retirement.